The April 2 U.S. Tariffs: Redrawing Global Trade Lines, Fueling New Alliances and Rivalries

With little warning but unmistakable intent, the U.S. government on April 2 unveiled a sweeping set of tariffs that could alter the very architecture of global trade. The policy, aimed at recalibrating America’s trade priorities, has already sent shockwaves through manufacturing hubs from Southeast Asia to Sub-Saharan Africa. Now, nations are scrambling to adapt to what many are calling the most consequential shift in U.S. trade policy in a decade.

Far from just a matter of duties and percentages, these tariffs carry geopolitical weight. They’re expected to recast alliances, rewrite supply routes, and in some regions, deepen economic fault lines that could evolve into full-blown disputes. While some nations will find themselves squeezed by the new rules, others are emerging as surprise beneficiaries — or at least contenders in a rapidly changing global marketplace.

A Global Reordering in Motion

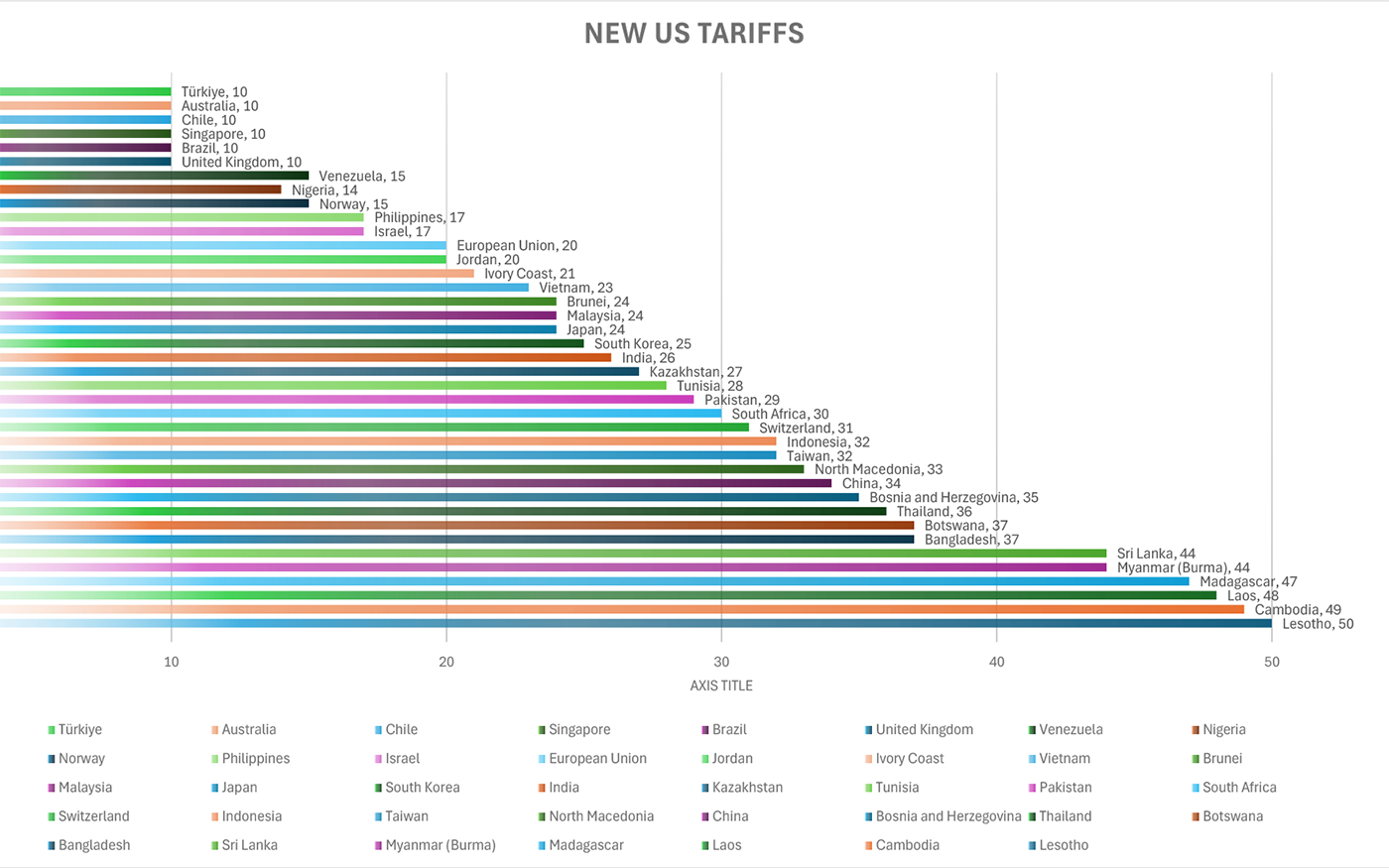

The new tariffs range dramatically, with developing economies like Lesotho (50%), Cambodia (49%), and Laos (48%) now facing punishing rates. Meanwhile, heavyweight players like China (34%) and Indonesia (32%) are seeing their trade calculus with the U.S. shift almost overnight. These measures are not mere technical adjustments — they are signals of a broader strategic reset.

For decades, the U.S. has shouldered trade imbalances and retaliatory tariffs from allies and adversaries alike. Now, American policymakers appear ready to test whether a more protectionist approach can revitalize domestic industry without igniting a larger trade war. That balance is far from guaranteed.

New Trade Opportunities — and Flashpoints

For a select group of countries, the tariff shake-up could prove to be an economic windfall — if they act quickly and strategically.

Türkiye: Positioned for a Comeback

At just 10%, Türkiye’s tariff rate leaves it well-placed to absorb manufacturing demand redirected from Asia. Long a textile and auto production powerhouse, Türkiye now finds itself at the center of renewed attention from American buyers. Its geographical proximity to both Europe and the Middle East only enhances its appeal.

Yet, Türkiye’s domestic troubles — spiraling inflation and a volatile lira — remain a risk. Still, those same issues make its exports cheaper in dollar terms, offering an edge that American importers may be keen to exploit. The challenge will be proving that Türkiye can deliver at scale — and with predictability.

Brazil: Resource-Rich and Ripe for Growth

Brazil, facing a similar 10% tariff, stands to gain in sectors where China is losing ground: steel, aluminum, and agricultural goods chief among them. The country’s biofuel industry, particularly ethanol, could also see a surge in U.S. demand, aligning with Washington’s clean energy goals.

What Brazil must avoid, however, is complacency. To truly capitalize, it will need to modernize infrastructure, cut red tape, and improve environmental practices — particularly under scrutiny from climate-focused investors in the U.S.

United Kingdom: Post-Brexit Realignment

For the United Kingdom, the timing is serendipitous. Still seeking solid footing after Brexit, London has long eyed Washington as its most logical trade partner. Pharmaceuticals, financial services, and high-tech goods remain key strengths — and with tariffs at a manageable 10%, U.K. firms have room to grow their presence across the Atlantic.

But U.K. officials know better than to take a favorable tariff as a guarantee of success. A future U.S.-U.K. free trade agreement is still a diplomatic aspiration, not a done deal.

🇲🇽 & 🇨🇦 North America’s Quiet Advantage

Though neither Mexico nor Canada enjoys the lowest tariff status, their existing integration with U.S. supply chains through the USMCA gives them a quiet edge. Both are expected to benefit as American firms seek to “friendshore” operations closer to home — a process accelerated by the new tariffs.

Factories in Monterrey and Toronto are already ramping up in anticipation of increased orders from U.S. buyers eager to bypass more heavily taxed Asian sources.

Central Asia: A Wild Card in Waiting?

Beyond the usual suspects, a quieter group of nations — including Uzbekistan, Kazakhstan, Azerbaijan, and Tajikistan — are suddenly gaining relevance. With natural resources, growing industrial bases, and a hunger for global trade, these Central Asian countries may become dark-horse candidates for companies fleeing high-tariff zones.

To turn potential into payoff, these countries must address infrastructure gaps, governance challenges, and lingering investor hesitance. But the door is open — and for some, this may be the moment to step through.

Global Trade Realignment — or Economic Flashpoint?

Though framed as a strategic correction, the tariff rollout could unleash consequences far beyond spreadsheets and shipping routes. Analysts warn that this policy may ignite retaliatory measures, particularly from China, which has already hinted at “appropriate economic responses.” The specter of a new economic cold war — less ideological, more transactional — is not far-fetched.

At the same time, the tariffs may inspire new trade blocs, particularly among mid-tier economies looking to band together for greater bargaining power. In that way, April 2 may be remembered not just for who gained or lost, but for how the entire structure of global commerce began to shift.

A Pivotal Moment — and a Test of Strategy

At its core, the U.S. tariff move is about leverage, not just economic, but geopolitical. And for many Americans, it signals something deeper: a new chapter of economic renewal at home.

Across the country, manufacturers are sensing opportunity. Investors are eyeing domestic industries with fresh confidence. And workers, after years of uncertainty about globalization, are seeing a future where “Made in America” is not just a slogan, but a strategy.

Rather than a risky gamble, this policy marks a bold repositioning — one that could revitalize U.S. industry, foster innovation, and inspire a new era of homegrown investment. If executed with foresight and partnership, this chapter could set the stage for a more resilient, more self-reliant American economy — and a rebalanced global order.